A loan, the bane of existence for many students, has always been an option to assist in the cost of higher education. Then there is also financial aid in the form of grants, scholarships and work study, which are offered to soften the blow of loans. For many years, the college financial aid system was complicated and seemingly tortuous for most students and their families.

Recently, long overdue developments in the system have been implemented.

Sandy Baum, a professor of economics at Skidmore College in New York, detailed the following developments in financial aid.

Baum mentioned income-based repayment for federal student loans. In simpler terms, the new system will limit monthly payments on federal student loans to a percentage based on the borrower’s income.

However, Baum stated that, “this system is not perfect, as while the government will pay the interest for some borrowers whose payments don’t cover it, others will see their debts grow as interest accrues.”

Any time the federal government increases gift aid programs, students benefit. The Pell Grant is awarded on a financial need formula and the maximum is set yearly by the U.S. Congress. The amount of the Pell Grant increased to $5350 from $4731 in 2008-2009 for students with zero Expected Family Contribution (EFC).

In addition, the EFC range was extended from $4110 to $4617. According to Ed Blaguszewski of the University of Massachusetts Office of News and Media Relations, more students will be eligible.

Now there is no escape from loans. But these recent developments in the repayment and source of loans are a welcome change.

Other notable changes include the sources of college loans, such as switching to the Direct Lending program from the Federal Family Education Loan Program (FFEL).

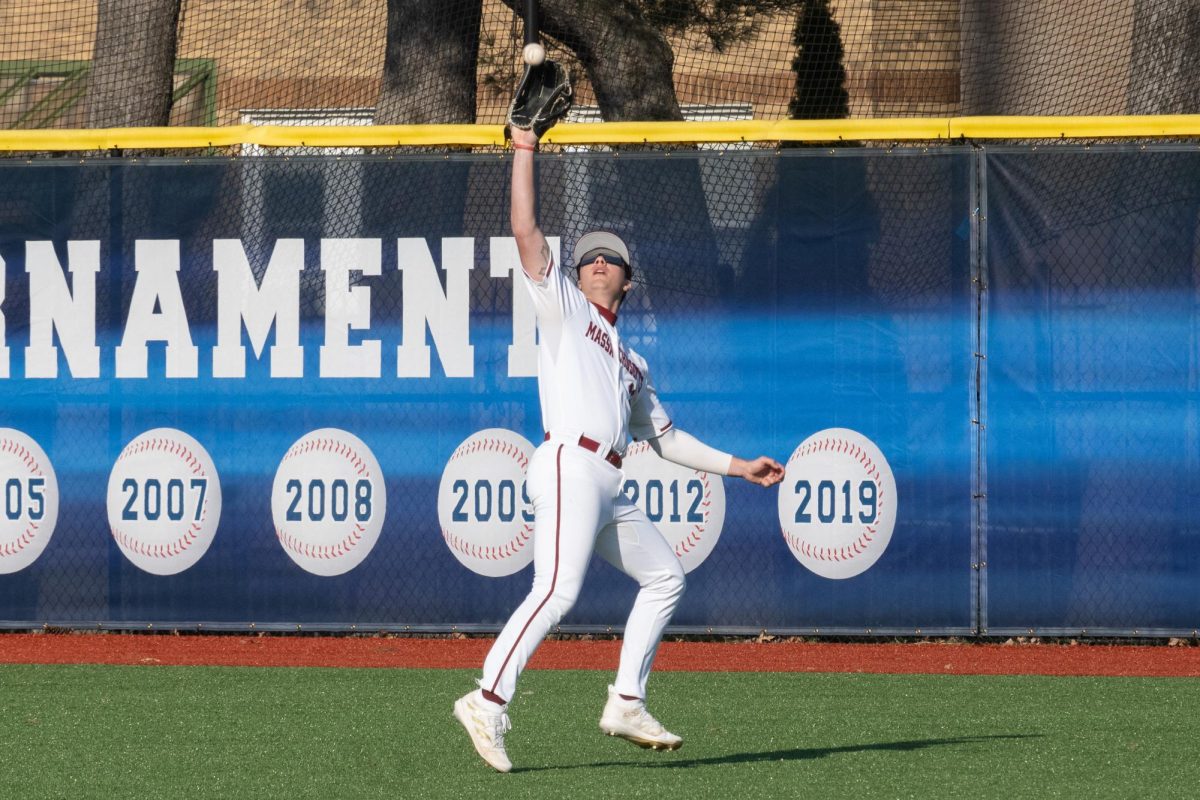

“UMass Amherst participates in the Direct Lending program, so the proposed change to eliminate lenders for the Federal Family Education Loan Program will have no negative impacts on our students,” Blaguszewski said. “There will not be the need for all students to complete any additional paperwork, which would occur on a campus that has to switch from FFELP to Direct Lending.”

Lastly, the Department of Education continues to work on ways to streamline the Free Application for Federal Student Aid (FAFSA). In the past, the FAFSA has been a complicated application process. Fortunately, the new application will significantly minimize the number of questions, especially specific questions that do not pertain to a student’s circumstances.

Blaguszewski acknowledged that in 2008-2009, more than 75 percent of UMass’s full-time undergraduates completed the FAFSA. This compares with about 45 percent of all public colleges and universities in Massachusetts.

Even with the improvements in financial aid system, some UMass students were still skeptical about how significant the changes would be.

“These changes are good, but I feel many students are still going to need all the financial aid they can get,” said Eduardo Manta, a sophomore student majoring in mechanical engineering. “We go to college to reap riches. What’s the point of college if we have to pay back endless loans afterwards?”

But with the rising tuition and living cost, other students were more appreciative of loans.

“I can’t complain about financial aid,” said Danny Weng, a sophomore transfer student. “Even though I dislike loans, they have enabled me to fulfill my dream for a college education.”

Davin Surin can be reached at [email protected]