After spending an entire summer working a crappy job in food service or an office without air conditioning, students look upon their bank accounts in glory as they consider all of the late-night Wings and bar tabs that they can now afford. However, many students find it difficult to stretch their hard-earned cash out through an entire semester.

The cost of textbooks and other school supplies present most student’s first financial hurdle at the beginning of a semester. Avoid draining your account by creating a budget for school supplies, taking account an inventory of any existing notebooks, pens and printer paper your household may have lying around. Then, ask friends and family members if they can donate any spare supplies before going out and purchasing them. Go to various Internet sites for popular school stores like Staples to see if they have any back-to-school promotional coupons you can print out for things you need. And definitely take care of securing all your school supplies before splurging on a new sweatshirt at the University of Massachusetts UStore.

Textbooks can be a particular waste of money – especially for those who have found themselves at the end of a semester never having opened a textbook. Wait until the professor hands out his syllabi for semester and gauge how important the book will be to the course material and whether or not it is available at the W.E.B. Du Bois Library. The Textbook Annex’s high prices, students should consider purchasing their books ‘used’ from sites like Amazon or Half.com. Need the book, but don’t want to pay over a hundred bucks for it? Make a friend in the first few days of classes who hasn’t bought the book either, go halfway on the price of the book each and take turns trading off between photocopying or scanning the book’s pages and keeping it – just be diligent about copying pages way before test time.

After purchasing all the necessities for one’s academic life, students may feel less confident about their bank accounts. The spending hasn stopped just yet, though.

The heaviest drain on the college student’s budget generally occurs on weekends where letting loose through or curbing boredom through partying or socializing can make money disappear rapidly. Having less cash at hand is key to keep from splurging.

Leave the plastic at home and opt for cash instead of carrying around a debit or credit card. Utilize the free ATMs on campus by only bringing a fixed amount of money to prevent going over budget. Carrying cash always helps when splitting restaurant bills, too.

Purchasing alcohol at a bar can be much more costly than from a liquor store, but that doesn’t stop the swarm on North Pleasant Street every weekend.

“Pre-gaming” before the bars is one way to prevent over-spending. A sufficient buzz before the bars may mean fewer Grateful Deads once out. However, it is important to remember that excess drinking can result in impulsive spending. Having only a fixed amount of cash comes in handy at this point.

Another way to cut down on a bar tab is to share a pitcher of beer with friends. For as little as $6 a pitcher at some bars, sharing between friends can minimize the price of a single beer – try to pick lightweight friends.

Indulging in Antonio’s after the bars and late-night Dominos orders often drain a student’s budget. Wings may seem like a good idea when students have the munchies, but a cheap meal can add up quickly with tip and drinks.

Instead of splurging all the time, keep quick grocery food snacks such as Easy Mac at hand. When grocery shopping, keep an eye out for discounts and always use your store savings card. Online coupons are another way to save, but students must beware of purchasing things they would not normally spend their cash on because of a coupon.

Tuesdays around Amherst are especially great with deals. Five-dollar movies at Cinemark and all-you-can-eat Wings are part of a college student’s greatest food and fun fantasies.

Do not forget to pick up a coupon book at the beginning of the semester, which are usually given out in Campus Center and the Dining Commons. These booklets have a huge array of coupons for local businesses.

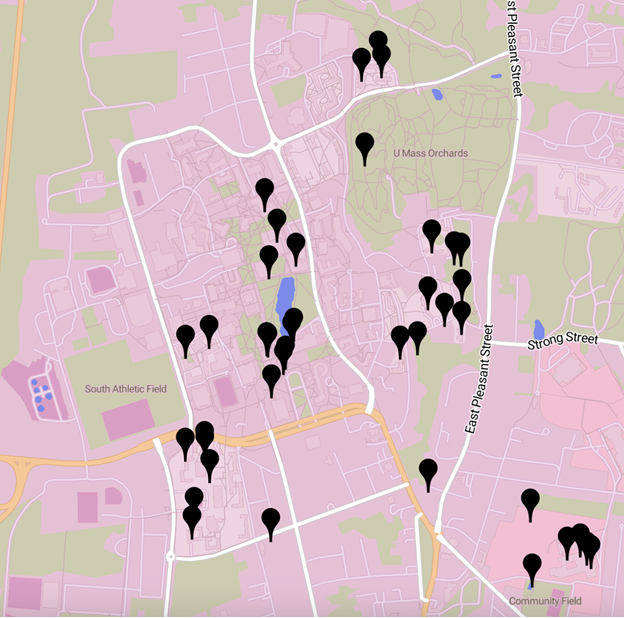

Sick of spending $10 or more on cover charges? Keep an ear and eye open for events happening around campus, most of which are free with a student ID. One of the benefits of such an enormous campus means there are always free events going on for students.

Acacia DiCiaccio can be reached at [email protected].