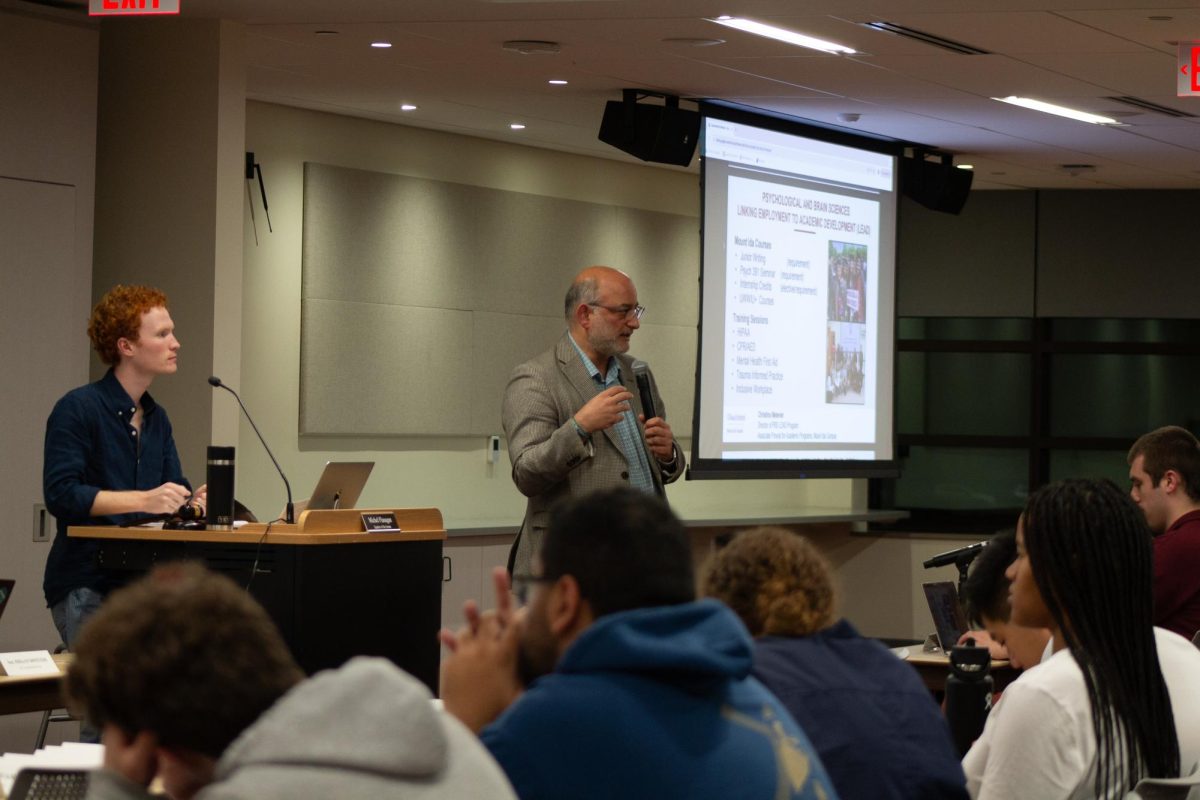

Representative Paul Mark met with thought leaders and student representatives from the University of Massachusetts Amherst community this past Friday to discuss student debt.

A passionate advocate for Massachusetts college students, Representative Mark made it clear that student debt debate needed to be reframed as a lifetime burden. “College education needs to be looked at as part of a lifelong process,” said Mark. Thus began the discussion to liberate Massachusetts students from this financial drudgery.

High college debt strangles graduating college student prospects in terms of future employment, opportunities and entering independent adulthood, according to Mark, who came to the University to reach out and find alternative solutions to the student debt crisis.

One of the highlights of the discussion was a presentation by Anastasia Wilson, a University of Massachusetts Amherst economics graduate student, whose findings quantified the relationship between state investment in higher education and a measurable decrease in tuition. Her research indicated that every dollar in increased appropriations per student results in a $.30 decline in tuition per student; a relationship that had not been quantified before.

The chief culprits of high student debt were also revealed during her presentation. Wilson observed that predatory mid-tier private universities are the foremost drivers of high debt for in-state Massachusetts college students. These schools concentrate scholarships and financial aid during freshmen year then pull a bait and switch. Remaining years are much more costly, indebting these students beyond any reasonable level.

Wilson’s presentation also noted a class discrepancy between student debt in “elite” universities, such as Harvard, Boston College and Tufts, and public institutions. These “elite” schools, with low state enrollment often below 20 percent, have near-zero default rates.

Meanwhile, schools with a majority of in-state students, both in public and private colleges, have graduated populations with around 10 percent default rates. These students are also expected to make considerably less than their “elite” counterparts despite amassing significantly higher debt.

These finds were particularly troubling as evidence was also submitted strongly indicating that high-debt graduates earn significantly less over a lifetime. High student debt decreases consumption and eliminates the possibility of graduates taking out other loans and mortgages. This prevents young adults from buying cars and houses. Their lives are financially frozen until the debt is paid.

Radical ideas were discussed to alleviate the end of the student debt crisis. Leading the discussion was Public High Education Network of Massachusetts (PHENOM), a network of thought leaders fighting for affordable, accessible and well-funded public higher education in Massachusetts. Representatives from Center for Education Policy Advocacy (CEPA) and the Student Government Association offered significant input from the student perspective. A chorus of students and related persons contributed to the discussion as well.

Revisions of the 50-50 plan envisioned alternatives where students are responsible for paying only their third and fourth years of college, with the state paying for the first two years, making most community college programs free. Additionally, this alternative would protect college dropouts from fruitless debt.

Ideas of social transfers between the “elite” universities and the public colleges were floated. A one percent tax was proposed on university endowments over a billion dollars to lower costs for public school students. This plan would allow public education to be free in Massachusetts, both at community colleges and four year universities.

Representative Paul Mark promised to make bold recommendations with each new session, inching forward with every cycle. He encouraged concerned students to email him at [email protected] if alleviating student debt was important to them.

Michael Turner can be reached at [email protected].

CrisisMaven • Jun 20, 2014 at 3:15 pm

The problem with student debt in “civilized” nations with social security systems is: at the moment, i.e. today’s generation, the students are amassing massive debt which needs to be repaid in the years following their graduation. Let’s even assume, they all get jobs. Now, the return on investment would be positive if the EXTRA amount of money earned up to retirement outweighs the amount paid for those loans. However, while the current and the immediately following generation(s) of graduates are paying back their debt they at the same time have to mandatorily pay into retirement schemes. This money is also taken out of their pocket. Now they’re pinched from both ends. However, that latter money has a negative ROI: no one in his/her right mind really believes that the welfare state can actually repay the payroll taxes, as by the time the current and following generation(s) of graduates are meant to retire, they public coffers will be totally empty. So we can see now already that these hard-working students will -in life balance- earn less than those who are unemployed from day one and never even finish high school …