Last week, a forum on Reddit made headlines when its members caused several hedge funds, who had short sold GameStop stock, to lose billions of dollars, pushing some to the verge of bankruptcy.

In order to grasp just how this happened, we must first understand the process of short selling. When you buy a stock, you invest in a company because you expect it’s value to go up, which in turn drives up the price of its stock. You can then sell this stock for a profit. For instance, if you buy stock for $1,500 and then sell it once its price bumps up to $2,000, you have made a pre-tax profit of $500. Short selling is the same process but in reverse. When someone short-sells a stock, they are betting that its value will go down. Here, the “sell” happens first, and then once the price falls, you re-purchase the stock at a lower cost, thereby earning money. If you short sell $1,000 worth of stock, for instance, and later buy it back for $800, you make a $200 pre-tax profit.

The catch is that short selling carries far more risk than buying stock does. If you buy a stock for $1,000, the worst that can happen is that its value goes down to $0, in which case you lose your $1,000 initial investment. When you short sell a stock for $1000, however, there is no theoretical upper limit to the amount of money you could lose. Say the stock goes up to $2,000 after you sell it, now you have lost $1,000. But it’s also possible for the stock to go upto $10,000, in which case you lose $9,000 and so on. In such a scenario, the more the stock rises, the more money investors lose.

Recently, several hedge fund managers short-sold their stock in GameStop, a 37-year-old video games retail chain. Once a favorite amongst avid gamers, GameStop’s business had recently been struggling, unable to cope with the rapid shift to an online marketplace. This situation was only exacerbated by the ongoing pandemic, with most consumers avoiding in-person retailers altogether. Wall Street picked up on this trend and began shorting GameStop stock. It made similar bets on AMC and other companies that were suffering during the COVID-19 pandemic.

Then Reddit came into the picture.

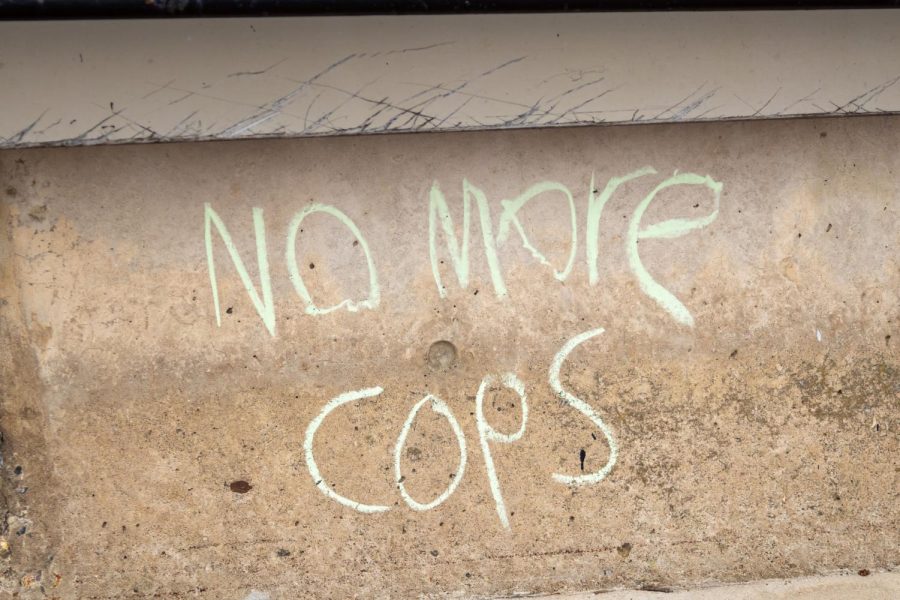

On a forum called r/Wallstreetbets, people noticed that hedge funds were short selling the GameStop and AMC stock. So, they banded together to buy hundreds of thousands of GameStop stock, which forced its price to skyrocket. This, they hoped would teach the hedge funds a lesson. This rebellion was seemingly motivated by a brewing frustration amongst amateur investors against the corruption in the financial industry. Their belief that Wall Street gets bailed out for crimes that everyday people can’t get bailed out for fueled this act of defiance.

The Reddit investors achieved their desired effect: they drove the stock price up remarkably. Valued at just $18.84 on Dec. 31, GameStop stock eventually rose to as much as $483 last week. This resulted in hedge funds incurring large losses.

Perhaps the most controversial part of the story occurs in what happens next. Robinhood, an app that allows users to buy and sell stock for free, restricted the purchase of GameStop and AMC stock. This led many people to make allegations of oligopolistic power. Some have speculated that Citadel, a hedge fund that short sold GameStop and makes up a large portion of Robinhood’s revenue, may have colluded with Robinhood in order to have them ban trading. However, there is no evidence for this.

However, many people simply do not understand the true reasons behind Robinhood’s decision. According to the CEO, the reason they banned trading was in order to comply with SEC regulations. The SEC has clearing house deposits and net capital requirements. These requirements are based on market volatility. In such a volatile environment where stocks can go up times-23 in a month, this makes it essentially impossible for the company Robinhood to keep up with these requirements without restricting the purchase of certain stocks. The real anger here should be directed at the government and the complex SEC regulations as financial services are one of, if not the most, heavily regulated industries in the US.

Critics might argue that if we deregulate the financial market, we will have massive fraud on Wall Street. I see no evidence of this. The 1990s and 2000s saw some of the largest frauds in U.S. history, including huge scandals from Bernie Madoff, Jordan Belfort, Enron and several others. Yet this was amongst the most regulated periods that the market hasever seen. Not to mention that the SEC did quite a poor job in preventing any of these large frauds for occuring on their own.

Fraud has been illegal since before the SEC even existed. In order to actually prevent fraud, the focus should be on enforcing the laws that are already on the books and punishing crimes when they actually occur, rather than trying to make new regulations to predict if someone is committing fraud. These regulations inevitably lead to unintended consequences and ultimately, as this episode shows, erode public trust in financial institutions.

Bradley Forrest can be reached at [email protected].