For many at the University of Massachusetts, part of the decision to attend the school may have been the cost of tuition. It is roughly $15,000a year for in-state students, and twice that for out-of-state students. There are also other expenses, such as room and board. But UMass, like other state schools across the country, offer the opportunity to graduate college with slightly less debt, not necessarily incurring upwards of six figures.

There are several thousands of other colleges around the country. This year, upwards of 20 millionstudents will attend them. A significant portion of those students will graduate in debt. Almost 40 percent of Americansunder age 30 are currently paying off their student loans.

American college graduates sit on almost $1.2 trillion in total debt and pay an average of $350 a month to escape it. Student loans are the second highest sourceof debt after mortgages, and over 10 percent of borrowers are behind in their payments. To put that in perspective, the highest delinquency rate during the 2008 mortgage crisis was 11.5 percent.

This is a problem that has steadily built for years and presents a tremendous risk for young people. The truth is that while there is a theorized “bubble”of student loan debt, we don’t know if it exists for certain, when it would burst or how it will react.

At the root of the problem, there are a number of factors. Students are willing to charge upwards of $50,000 a year to get a college education that they believe will increase their abilities in the job market, while their families toss out the traditional truth of “not buying what you can’t afford,” resulting in the possibility of six-figure debts for graduates.

This reality scares me. I was nine when the housing market crashed, but I can imagine that some of the patterns from that time are reflected in today’s current situation. There is a general ignorance about the dangers of debt. It is a crushing weight to have on your back and keeps you under it for as long as possible.

I’m worried that even a family who is fortunate and far-sighted enough to have saved money for college will be caught up paying for their high school graduate’s “dream school.” The student may apply Early Decision to the school without thinking of the fact that they may not get financial aid. When the bill finally comes, the soon-to-be college graduate will take on debt over $100,000. This scene will play out many times across the country.

Time Magazine reported last year that the average starting salary for a college graduate is just under $50,000, an increase from past years. On that salary, you may be able to afford to pay off your debt at $350 a month, as the average graduate does, but it still could take you over 20 years to escape your college payments. At the beginning of the same Time Magazine article, you’ll find a less exciting and brutally truthful message: “Congratulations class of 2017! You just might have a prayer of paying off your student loans!” Not exactly the most positive outlook on the situation.

It’s easy to hope for a solution and quickly settle on the idea that public colleges should be free for those under a certain financial threshold. But that would cost somewhere in the range of $75 billion, would result in higher taxes and may oversaturate the job market to the extent that finding work would be significantly more difficult.

It’s also a revolutionary idea, based on far-left principles, that has little hope of passing the currently Republican-dominated government.

Instead, we should look for different solutions. We should evaluate when college is necessary to our long-term goals, hold our schools to standards of spending that reflect what we’d like to be paying and encourage graduating high school students to be smart and think about what implications their college decision will have two or three decades down the road.

The idea of graduating with crushing debt worries me, as does the fact that year after year, many high school seniors put pressure on themselves to end up at the “right school” without any thought of whether they can afford to go there or even if going to that school will have any effect on their happiness or job safety in the long term.

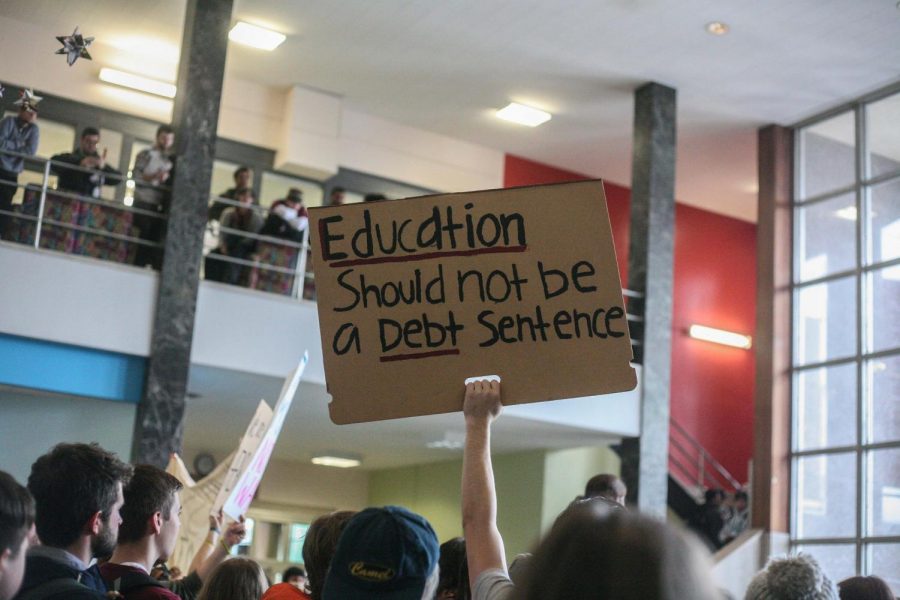

The solution to the problem may be complex, but the way we get there is simple. Stay aware, stay involved, make your voice heard and hold your school responsible for its financial decisions. There’s a solution out there, and I can’t pretend to know it, but we’ll find it.

Will Katcher is a Collegian columnist and can be reached at [email protected] and followed on Twitter at @will_katcher.

Zac Bears • Apr 8, 2018 at 12:26 pm

We could have eliminated all student debt for the cost of GOP tax giveaway to the rich. Free college is not a radical idea. Public college was free in the US until the 1980s.

NITZAKHON • Apr 5, 2018 at 8:50 am

Stay out of my taxpaying pocket, you slaver.

Ed Cutting, Ed. D. • Apr 5, 2018 at 6:28 am

Don’t buy into the myth that public colleges are cheaper than private ones — what’s not being said is that the private colleges are discounting their tuition on average, 47%, nationally. However, your FinAid is still based on the full list price — hence you get more $$$$$

Someone, memory is Forbes, recently did a study and it showed that a lot of people will pay less attending Amherst College than UMass!!!

Hence the UMass mantra of “we may suck, we may be expensive, but we’re still cheaper than a private school” is no longer true. And the bottom line is that higher education right now is a buyers market — there are way more seats in colleges than there are bodies to fill them.

And the demographics are not in the colleges’ favor — everyone born in the 20th Century is now 18 and the Millenials are aging out of college, and high school enrollment in the places that UMass draws from — the Northeast and Midwest — is plummeting. Forget financing, the kids don’t exist.

I’ve seen estimates that upwards of 25% of colleges will go broke in the next decade. Some already have, others (like Hampshire College) are probably on quite shaky grounds right now.

I don’t think Whitmore understands this — nor will until, one fall, the kids don’t show up anymore….