(Katherine Mayo/Daily Collegian)

Federal Reserve Chairwoman Janet Yellen announced the Federal Reserve’s intentions to raise interest rates within the coming year, as well as subsequent intentions to further raise rates as the market allowed.

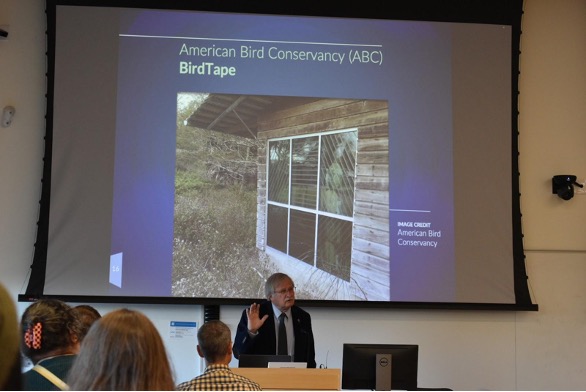

This comes off the recent Federal Reserve announcement that they would not raise interest rates. The speech, given as the 19th annual Phillip Gamble Lecture at the University of Massachusetts, highlighted the issues faced by the general public when it came to low inflation.

“An unexpected decline in inflation that is sizable and persistent can also be costly because it increases the debt burdens of borrowers,” Yellen said, going on to describe the situation of “debt deflation” as potentially very severe for the general economy and the working public in particular.

Citing the Fed’s goals of total employment and two percent inflation, Yellen defended the move to hold off on interest rate raises.

“Fortunately, prospects for the U.S. economy generally appear solid,” the chairwoman said, remaining optimistic about the Reserves efforts to anchor inflation. Yellen also responded to critics of the Fed’s plans to hold off on raising rates for the time being, emphasizing that policy makers would be “unwise” to hold to expectations that the economy would return to predicted strength.

Citing the Japanese recovery as precedent, the Fed was clear to assert that “economist’s understanding of the dynamics is far from perfect, the predictions of our models often err, sometimes significantly so.”

“Accordingly,” Yellen continued, “inflation may rise more slowly or rapidly than the Committee currently anticipates; should such a development occur, we would need to adjust the stance of policy in response.”

This return comes amongst increased scrutiny of both Yellen and the greater Federal Reserve’s authority over monetary policy as well as the effectiveness of its policies. Yellen was clear in her assessment of what she called “accommodating factors” – policies set forth by the Reserve following the recent recession, targeted at spurning economic growth – emphasizing the positive impacts they had had not only over unemployment but also the quality of life for the average American citizen.

Despite this apparent optimism, Yellen remained steadfast in her assertion that rates would not be raised by the Reserve until both unemployment and inflation reached desired rates. This announcement was met with positive reaction by the economics faculty at the University.

“I was glad to see her commitment to the American worker, and the caution she’s exercising with American monetary policy is admirable,” economics professor David Kotz said, echoing much of the reception held by those who attended.

Gerald Epstein, chair of the Economics Department, made it clear that having Yellen on as the Gamble lecturer was a boost to the profile of the University’s profile.

“While we’ve had a star studded series of lecturers in the past including Thomas Piketty, clearly having a Reserve Chair is one of the most prominent guest that the University had entertained.”

The lecture was given to a sold out audience at the Fine Arts Center, with attendance estimated at 1,800 people.

There was some concern with Yellen, however, who had a great deal of difficulty finishing her 40 page lecture. Long pauses and apparent disorientation prompted an ambulance to arrive following the chairwoman’s speech. Yellen was attended to, and ultimately was cleared medically by paramedics. Epstein, when asked about the chairwomen’s health, stated that both a hot stage and the lighting were partially to blame for the Fed leader’s issue, confirming that Yellen was alright.

Daniel Mahoney can be reached at [email protected].

Mark Kaye • Sep 25, 2015 at 10:49 am

As the “independent” heard of the Federal Reserve Janet Yellen fails to address the other two components that affect the US economy, perhaps more so than the FOMC interbank interest rate: 1) government regulations; and 2) government taxes.

Also, by not allowing interest rates to reflect real market determined rates she supports a centralized management of the economy that she herself admits is unknowable and uncontrollable.

The Soviets tried the same thing with their never ending 5 year plans and we all know how well that worked out.